When to Consider Financing

June 22, 2018

Life can easily knock you down financially. For many, unforeseen expenses accumulate at the worst times. What can go wrong when owning a home? Common issues include a malfunctioning air conditioner, furnace, water heater, or sump pump. Combined with regular expenses like your mortgage or a car payment, these repair or replacement costs can seem daunting. We know that plumbing, heating, and cooling equipment costs and services are expensive – and oftentimes unexpected – and we want to help in any way we can.

Reasons to Finance

When you have an expensive month (or year), you can rely on Hanson’s Plumbing & Heating to turn financial burdens into a manageable payment process. Financing helps build your credit score. You can pay the balance off over time, especially when money is tight. Having the ability to consistently make payments each month eases budget forecasting.

Even if you can afford the entire cost of a repair or replacement, you’re essentially borrowing from yourself instead of a lender, and you still need to pay yourself back. Financing can allow you to comfortably upgrade the system you would feel safe purchasing with your own money. Many times, the energy savings and rebate opportunities available for a more sophisticated system can offset the extra costs associated with the original purchase. Special financing rates on higher-end equipment may offer lower monthly payments than those with rates for more standard equipment.

As with a car or a home, there is no shame in financing heating, cooling, or plumbing equipment or services. Many of our customers at Hanson’s Plumbing & Heating take advantage of the financing simply because it allows them to budget and plan their expenses. Financing gives you the opportunity to purchase additional comfort and energy saving accessories like smart thermostats, dehumidifiers, humidifiers, air purifiers, home automation, specialized surge protectors, and more!

Be Cautious and Smart

Before you decide to finance a major purchase, consider your options with your bank. Choosing a longer payment plan racks up total interest and annual percentage rate (APR). We suggest putting more than 20 percent down before going on a financing plan, too. Another tip is to check that your minimum payments will not surpass more than 10 percent of your income. This way, any large financial changes in the future remain manageable. If possible, we recommend paying more than your minimum balance to decrease the accumulated APR or final interest over time.

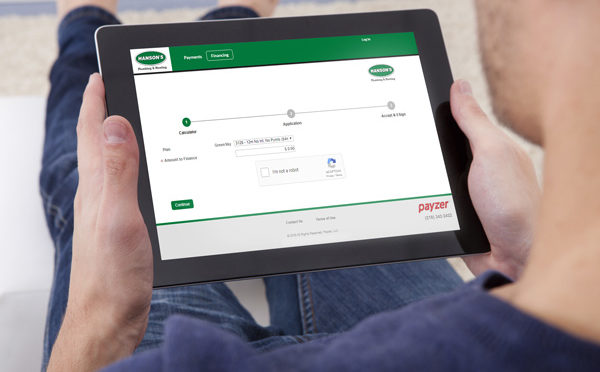

Use the convenient online financing tool on our website. You can calculate your monthly payment, apply for the loan, and make payments towards your purchases through this tool.

We offer four plan options on our website:

- GreenSky – No interests or payments for 12 months (84 months)

- GreenSky – 9.99 percent APR (96 months)

- Fortiva – Standard with interest

- Fortiva – Deferred with interest

Consult with our estimators to learn about additional financing options and promotional rates for specific equipment. Typically, equipment of higher value allows for better financing offers.

Don’t stress. Financing plans can help you budget large, unexpected expenses with heating, cooling, and plumbing costs.

Contact us today to learn more about our financing options.

Subscribe

Subscribe Subscribe

Subscribe

Leave a Reply

You must be logged in to post a comment.